Indicators on Matthew J. Previte Cpa Pc You Need To Know

Indicators on Matthew J. Previte Cpa Pc You Need To Know

Blog Article

The Greatest Guide To Matthew J. Previte Cpa Pc

Table of ContentsThe smart Trick of Matthew J. Previte Cpa Pc That Nobody is DiscussingThe Definitive Guide for Matthew J. Previte Cpa PcThe smart Trick of Matthew J. Previte Cpa Pc That Nobody is DiscussingMatthew J. Previte Cpa Pc Can Be Fun For AnyoneThe Only Guide to Matthew J. Previte Cpa Pc7 Easy Facts About Matthew J. Previte Cpa Pc Shown

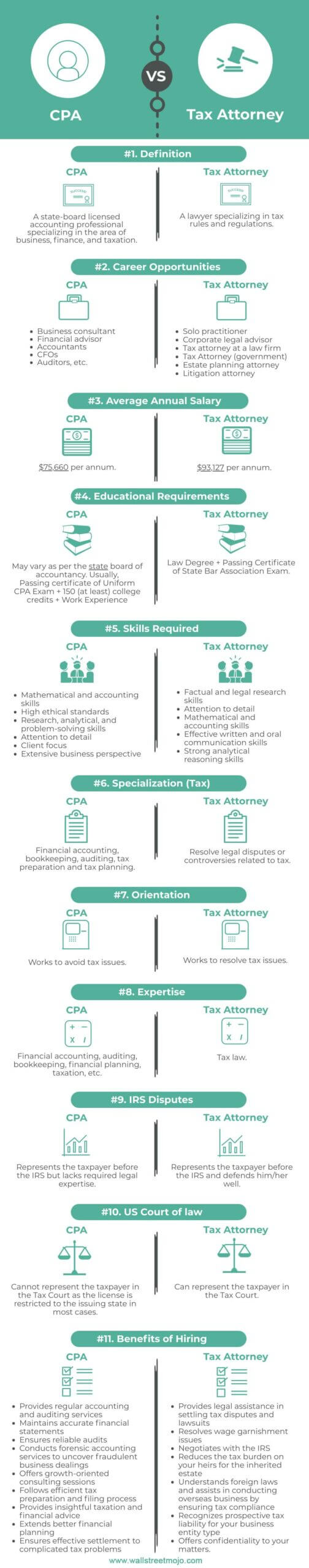

Even in the most basic economic circumstance, filing state and/or government tax obligations can be a daunting yearly task. When it involves navigating intricate tax obligation problems, however, this complex procedure can be downright frightening to deal with on your very own. Despite your earnings, deductions, house demographics, or occupation, working with a tax attorney can be beneficial.Plus, a tax lawyer can speak to the IRS on your behalf, conserving you time, power, and irritation. A tax lawyer is a kind of attorney who specializes in tax obligation legislations and procedures.

Matthew J. Previte Cpa Pc Can Be Fun For Anyone

If you can not please that financial debt in time, you may even deal with criminal costs. For this reason, impressive tax obligation debt is a great reason to employ a tax obligation alleviation lawyer.

A tax attorney can also represent you if you select to deal with the internal revenue service or help create a technique for settling or clearing up the deficiency. The means you framework and manage your businessfrom creation to daily operationscan have remarkable tax obligation implications. And the wrong decisions can be costly. A tax lawyer can offer assistance, assist you identify exactly how much your organization can anticipate to pay in taxes, and recommend you of approaches for lowering your tax obligation worry, which can aid you stay clear of pricey blunders and unforeseen tax expenses while taking advantage of specific guidelines and tax obligation policies.

Selecting a tax obligation attorney must be done very carefully. Here are some means to raise your chances of finding the right person for the job: Prior to working with a tax obligation lawyer, recognizing what you need that attorney to do is essential.

Some Known Details About Matthew J. Previte Cpa Pc

It's important to recognize your scenario's complexity and the price of the lawyer( s) you're thinking about, as the bill can vary extremely. Some tax relief companies provide plans that offer tax obligation solutions at a flat rate. Various other tax lawyers may bill by the hour. There is no right or incorrect, but it is necessary to understand what you're strolling into and what solution type you can anticipate for the cost.

With tax obligation attorneys that bill hourly, you can expect to pay in between $200 and $400 per hour typically - https://urlscan.io/result/805b6ff4-0415-4957-a228-a281241ad3e7/. Your last price will certainly be figured out by the intricacy of your scenario, exactly how rapidly it is minimized, and whether continued services are necessary. A standard tax obligation audit might run you around $2,000 on standard, while completing an Offer in Concession might set you back closer to $6,500.

The Matthew J. Previte Cpa Pc Diaries

The majority of the moment, taxpayers can deal with personal earnings tax obligations without way too much problem however there are times when a tax attorney can be either a handy source or a required companion. Both the IRS and the California Franchise Business Tax Board (FTB) can obtain quite hostile when the rules are not complied with, even when taxpayers are doing their ideal.

Both government companies carry out the revenue tax code; the IRS deals with federal taxes and the Franchise Tax Board deals with California state taxes. Federal Tax Liens in Framingham, Massachusetts. Since it has fewer resources, the FTB will piggyback off outcomes of an internal revenue service audit however concentrate on locations where the margin of taxpayer mistake is higher: Transactions including resources gains and losses 1031 exchanges Past that, the FTB tends to be much more aggressive in its collection methods

Matthew J. Previte Cpa Pc for Beginners

Your tax obligation attorney can not be asked to affirm against you in legal procedures. A tax obligation attorney has the experience to attain a tax negotiation, not something the individual on the road does every day.

A certified public accountant may know with a couple of programs and, also then, will certainly not always recognize all the provisions of each program. Tax code and tax legislations are intricate and frequently transform yearly. If you remain in the internal revenue service or FTB collections process, the wrong guidance can cost you very much.

Matthew J. Previte Cpa Pc Things To Know Before You Get This

A tax obligation lawyer can likewise aid you locate ways to decrease your tax bill in the future. If you owe over $100,000 to the IRS, your situation can be placed in the Huge Dollar Device for collection. This unit has the most skilled agents helping it; they are aggressive and they close this article situations quickly.

If you have possible criminal concerns coming into the examination, you absolutely desire an attorney. The IRS is not recognized for being overly receptive to taxpayers unless those taxpayers have cash to turn over. If the internal revenue service or FTB are disregarding your letters, a tax attorney can prepare a letter that will certainly get their focus.

Report this page